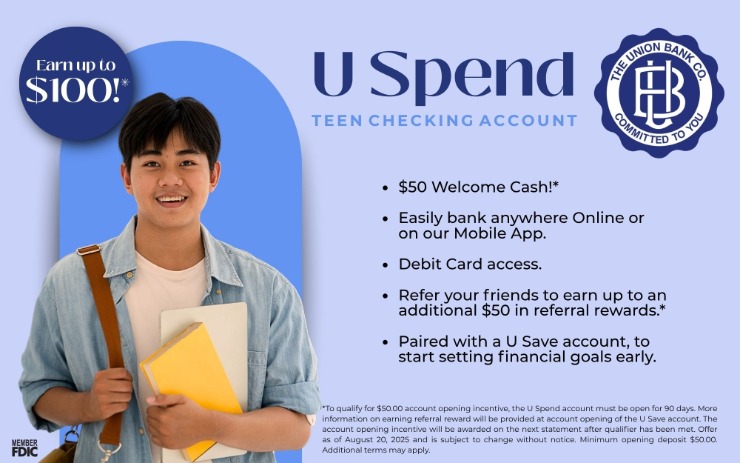

Whether you're looking for your first checking account or one that offers great rewards, we've got you covered!

Whether you're looking for your first checking account or one that offers great rewards, we've got you covered!

Our newest account is focused on teaching teens financial literacy and about making financially sound decisions. Stop into your local branch with your teen to open their account today.

Your debit card has the following shopping and security benefits:

Your debit card has the following shopping and security benefits: With our Mobile App, you can build your Digital Wallet for banking on the go:

With our Mobile App, you can build your Digital Wallet for banking on the go:

Open an Account Online - Apply Today! You now have the option to begin the online account opening process in a more convenient way than ever.

Open an Account Online - Apply Today! You now have the option to begin the online account opening process in a more convenient way than ever. Communications Center is available during business hours to take your calls, texts, emails or live chat messages.

Communications Center is available during business hours to take your calls, texts, emails or live chat messages. Create a budget. Budgeting enables you to meet your goals and prioritize your expenses.

Create a budget. Budgeting enables you to meet your goals and prioritize your expenses..jpg) IntraFi Network Deposits Have excess cash balances automatically sent from your transaction account to an interest earning account.

IntraFi Network Deposits Have excess cash balances automatically sent from your transaction account to an interest earning account.